Finance and Investments

Economic Performance and Financial Strategies

Investment Activities and Future Outlook

In 2024, Enerjisa Üretim signed a major financing agreement worth $1.012 billion for the 750 MW portion of our YEKA-2 project. This agreement represents not only a major investment but also a strong vote of confidence from the international financial community in Türkiye’s clean energy future. With the support of leading local and global financial institutions including DFC, JP Morgan, HSBC, KfW IPEX-Bank, DEG, Proparco, and Akbank, we established a solid financial foundation for the project.

As we head into 2025, we are actively engaged in financing discussions for the remaining 250 MW portion of YEKA-2, as well as for our wind energy projects in Edirne and Balkaya, which we are developing under YEKA- 2024 and which will have a combined installed capacity of 750 MW. These projects represent not only a significant increase in capacity but also major steps forward in Türkiye’s green energy transition.

To safeguard our financial position amid high market volatility, we executed foreign exchange (FX) hedging transactions totaling over $1 billion, effectively neutralizing the impact of exchange rate fluctuations on our balance sheet. We adopted a similarly disciplined approach to interest rate risk, implementing interest rate swaps (IRS) also exceeding $1 billion.

We also honored our dividend commitment for 2024, distributing $165 million in full to our shareholders by March 2025. This strong performance reflects the effectiveness of our strategic financial management, the trust of our investors, and our unwavering commitment to long-term value creation.

Green Finance Framework

At Enerjisa Üretim, our commitment to sustainability goes beyond our operational processes; we are also aligning our financial strategies with this focus. Through our Green Finance Framework, we are establishing dedicated financing structures for projects that generate environmental benefits, laying a strong foundation for our long-term climate goals. This framework also allows us to build deeper sustainability partnerships with our investors.

Our framework is fully aligned with the Green Bond Principles (2021) of the International Capital Market Association (ICMA) and the Green Loan Principles (2023) of the Loan Market Association (LMA). Under this framework, the proceeds from green financial instruments will be exclusively allocated to projects involving solar energy, wind energy (both onshore and offshore),and hydroelectric projects that meet specific eligibility criteria. For example, only run-of-river plants, those with a power density above 5W/m2, or projects with lifecycle emissions below 100 gCO2/kWh are supported.

Excluded sectors include fossil fuel production and use, nuclear energy, deforestation-related activities, the arms and defense industry, gambling, tobacco, and any activity that could harm the environment or biodiversity. The eligibility assessment and selection of projects are meticulously managed by the Green Finance Working Group, which includes representatives from our CEO, CFO, Treasury, Sustainability, and Strategy teams. This group is responsible not only for identifying eligible projects but also for overseeing fund allocation and leading the preparation of annual impact reports.

Enerjisa Üretim is targeting net-zero carbon emissions by 2040. To this end, we are committed to growing solely through renewable energy investments. In this context, we continue to grow solely through renewable energy investments; by achieving our target of 7,500 MW of installed capacity by 2030 mainly through these investments, we demonstrate our commitment to a sustainable future. Our YEKA-2 Wind Power Plant project plays a key role in achieving these goals. With 1,000 MW of installed capacity expected to come online through this project, we anticipate avoiding approximately 2.3 million tons of CO2 emissions annually.

All projects supported under the Green Finance Framework undergo comprehensive environmental and social impact assessments, in line with national regulations and the Equator Principles. We uphold the highest environmental standards in areas such as biodiversity conservation, water resource management, community engagement, and stakeholder participation. For instance, the YEKA-2 project includes extensive biodiversity assessments covering flora, fauna, and bird migration routes.

Our framework has been rated “Dark Green” by S&P Global in its Second Party Opinion (SPO) report,indicating strong alignment with a long-term low- carbon and climate-resilient future. This classification demonstrates that our financing framework is highly aligned with a long-term, low-carbon, and climate-resilient future. The SPO also highlighted several strengths, including our robust environmental risk management structures, measures against physical climate risks, climate risk analyses aligned with the TCFD, and the transparency of our energy transition strategies.

The allocation and use of funds are monitored transparently, and we share annual reports with investors to track performance indicators such as CO2 emissions reductions, renewable energy generation (MWh/ GWh),and added installed capacity (MW). This transparency allows investors to directly measure the impact of their capital and make data-driven decisions on sustainable investments.

Our Green Finance Framework, along with the SPO we received, not only supports the development of Türkiye’s green finance market but also serves as one of the most concrete tools in realizing our company’s long-term climate vision.

Our Green Finance FrameworkSecond Party Opinion

With 1,000 MW of installed capacity expected to come online through our projects, we anticipate avoiding approximately 2.3 million tons of CO2 emissions annually.

Commercial Operations and Market Optimization

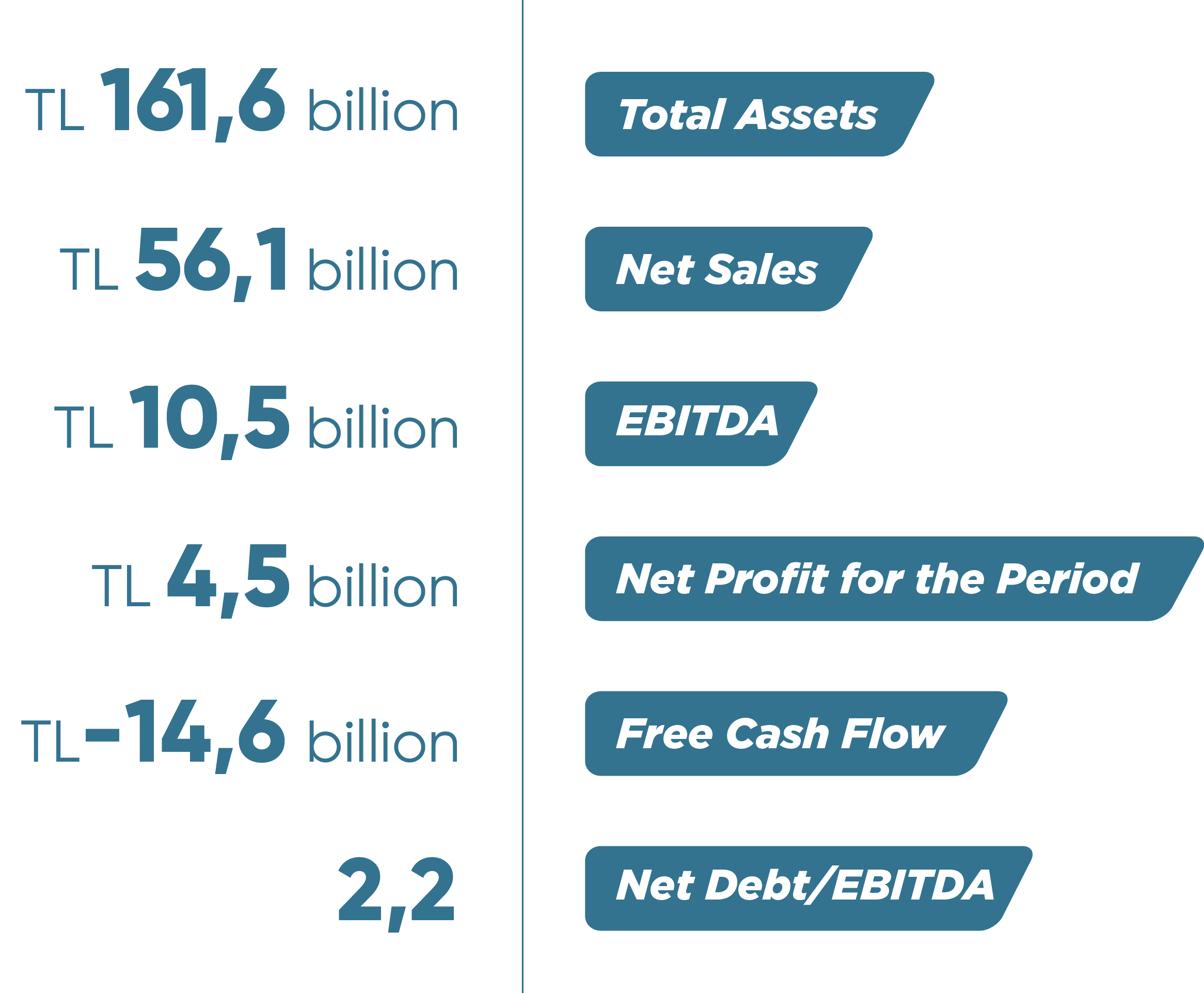

In 2024, Enerjisa Üretim remained focused on maintaining a strong and balanced financial structure by closely monitoring financial risks. Our leadership team and finance teams proactively developed strategies throughout the year to mitigate currency, interest rate, and liquidity risks.

As part of this effort, we conducted detailed analyses of:

Our current and projected balance sheet structure,

Cash flow and profitability expectations,

Financial risk levels.

In a year marked by high inflation, tight monetary policy, and volatile market conditions, currency, interest rate, and liquidity risks remained at the top of our financial agenda. Effective cash management, debt servicing capacity, and balance sheet strength emerged as key tools in navigating these risks.

Given our ongoing investment phase, liquidity management and access to financing became top priorities. Accordingly, we successfully secured financing for our YEKA-2 projects.

To support investment decisions, we conducted in- depth due diligence processes, including comprehensive analyses of target companies and assets. . These evaluations involved stress testing revenue forecasts and market scenarios, along with net present value (NPV) analyses.

Key steps we took to build a solid and disciplined financial framework that supports our sustainable growth include;

Managing cash flows in multiple currencies to minimize exchange rate exposure,

Using long-term financial instruments to balance interest rate and liquidity risks,

Monitoring and managing credit risk through models that account for the financial strength of counterparties.