In the light of our principle of operational excellence and our culture that focuses on people, we develop our value creation strategy in business areas that create synergy with each other.

Thanks to our balanced and diversified energy generation portfolio with low carbon intensity, mostly consisting of CCGT and renewable energy sources, we continue to contribute to Türkiye's renewable energy targets in the near future and fulfill our commitments on sustainability. While we are taking firm steps towards our growth targets, we are also contributing to the energy sector at large with a technology development- oriented approach.

Within the framework of our growth strategy, we will continue to generate 5% of Türkiye's energy needs and maintain this rate at all times. We will continue to grow in the future, focusing solely on our renewable energy investments.

While we are expanding our footprint in Türkiye in energy trade every single day, we are becoming a global player by spanning out across the European markets under the Enerjisa Commodities brand. As of 2023, we will be offering personalized digital solutions to both our stakeholders in Türkiye and international third parties through Senkron.Digital Energy Services' industry experience and data-empowered decision-making mechanisms.

We believe that sustainability will prevail not only with our generation centres hosting low carbon intensity, but also with a culture that strives to advance society. We seek new challenges and learning opportunities with our respect for life, occupational health and safety.

By investing in sustainable, new, disruptive and green technologies, we shed light not only on Türkiye but also on the entire sector in energy transformation. We ensure the development of Türkiye's energy ecosystem by establishing collaborations with start-ups, Venture Capital Partnerships and universities respectively.

We signed a loan agreement of 110 million USD with the European Bank for Reconstruction and Development (EBRD) and financed the company's renewable energy investments and wind power plant procurement. In addition, we have taken the necessary steps for the financing of YEKA-2 projects (~ 1.2 Billion USD) and continue our efforts to complete them in 2024.

We hedged over 1.2 billion USD by applying effective risk management against sharp exchange rate movements. Within the scope of our sustainable dividend target, we have made 115 million USD of the 165 million USD dividend payment in 2023, that we had committed to our shareholders regarding the 2023 year-end profit, and will complete the remaining 50 million USD in the 2nd quarter of 2024.

Metrics related to financials based on the Turkish Financial Reporting Standards

(TFRS)

(excluding the inflation accounting standard)

Metrics related to financials based on International Financial Reporting Standards (IFRS)

(including the Inflation accounting standard)

Our Active/Liability Committee, which was established with the participation of senior management to evaluate financial risks and plan actions accordingly, continued to evaluate financial risks proactively as well as regularly in 2023.

In this context, the committee evaluated and determined;

Our committee constantly contributes to the Financial Risk Management Policy and updates it in accordance with evolving needs.

In 2023, due to various factors such as adaptation to changing regulations, high inflation and tight monetary policies of central banks, the management of exchange rate, liquidity and interest risks came to the fore as financial risks that should be closely monitored and action taken accordingly. In this context, cash flow management, debt service capability and strong balance sheet analysis played a critical role in Enerjisa Üretim's management of these risks and achieving optimum financial results.

The due diligence process, which is important in determining the financial, operational, strategic and legal risks of the investment, includes a comprehensive review of the target company and assets and includes sensitivity and market analysis. These analyses enable detailed examination of company valuation and income parameters, allowing the net present value to be analysed with the Monte Carlo simulation in stressful scenarios. Enerjisa Commodities' activities in organized markets make the collateral needs assessment and liquidity management in accordance necessary.

Our financial risk management aims to reduce exchange rate risk on the balance sheet by managing cash flows consisting of various currencies. In this context, exchange rate risk management is optimized by using forward options and synthetic derivative products. Liquidity and interest rate risks are also carefully managed. In addition, credit risk management includes evaluating the counterparty's credit quality with a simulation-based scoring model and effective monitoring of concentration risks.

We continue our efforts to further increase the share of renewable energy in our generation portfolio, with wind and solar power plants at the centre.

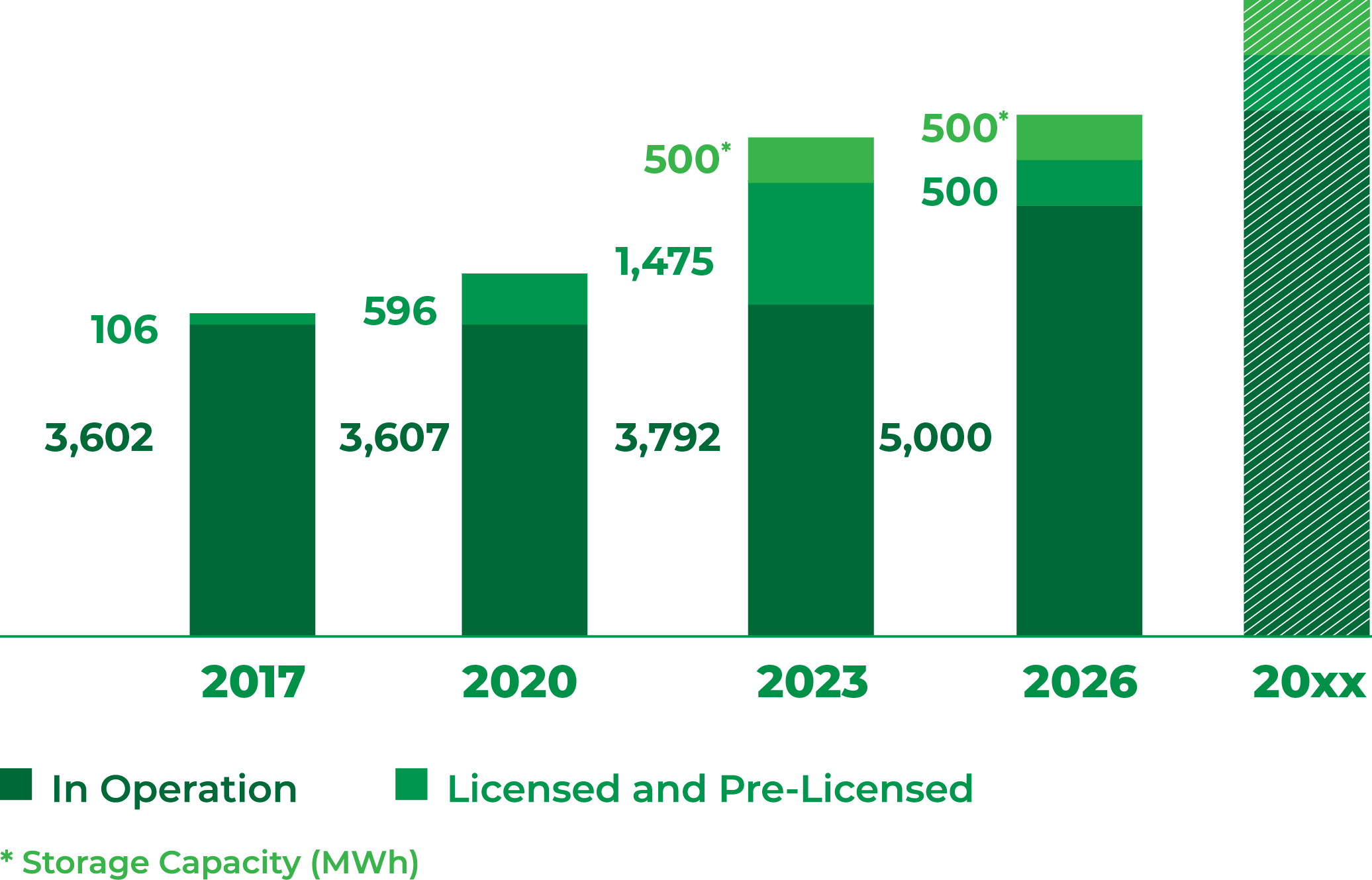

We plan to increase our generation capacity to over 5,000 MW within 5 years with our investments in both wind and solar power plants, increasing our share of renewable energy to 60%. The most important stage of this growth is the total capacity of 1,000 MW in the 4 connection regions that we have added to our portfolio as a result of the YEKA WPP-2 tenders held by the Ministry of Energy and Natural Resources. We aim to gradually complete this capacity by the first quarter of 2026, and will make an investment of approximately 1.2 billion dollars for the entire capacity during this process.

We have completed the Environmental Impact Assessment (EIA) processes in all our YEKA WPP-2 projects for which pre-licenses have been obtained. We completed the necessary permits and construction works for our 25.2 MW Akköy WPP project, located in the Aydın connection region, followed with the commissioning of the entire capacity in December. Thanks to this project, which we have commissioned much earlier than our targeted date, we have successfully completed a very important step in our YEKA WWP–2 investments. We continue to carry out the necessary work for our remaining YEKA projects whose investment process is still on-going.

In order to strategically support the growth in YEKA-2 project regions, we entirely took over the shares of the companies that own Çeşme WPP with an installed capacity of 18.9 MW, which has been operating since 2015, together with Dikili WPP with an installed capacity of 7.2 MW, which has been operating since 2020 We are making our plans in line with our capacity increase rights for an additional 3.6 MW for Çeşme WPP and 19.2 MW for Dikili WPP.

We also completed our capacity increase work at Erciyes WPP, which we had commissioned in 2022, followed with the commissioning of 4 more turbines with a total installed power of 13.6 MW. Thus, we have increased the total installed power of Erciyes WPP to 93.6 MW, including 78.6 MW wind and 15 MW solar. In line with the capacity increase right we hold for our Akhisar WPP located in Manisa province, we signed off the turbine supply contract and started the necessary field work. Following the completion of this work, we will be able to add a capacity of 7 MW to our portfolio.

We continue our investments in the field of hybrid solar power plants uninterruptedly by moving into the project design processes of these plants, which we aim to establish in 2024.

By initiating storage for our WPP project developments, we have received a pre-license for 500 MW wind energy generation and 500 MW battery storage capacity for our Malkara Storage WPP, 19 Mayıs Storage WPP and Izmit Storage WPP projects respectively. In addition to all these, while we are taking steps to grow with renewable energy based on wind and solar, we are strengthening our journey by giving importance to new technologies and start-up collaborations such as wind turbines, which we continue to commission at our Bandırma Energy Base.