TRADE

We transform

energy into

solution.

We analyze the needs of our stakeholders accurately by reading the market dynamics well. We manage risks with the tools we have developed. We create value for our business partners and stakeholders in every link of the trade value chain with our structured commercial products.

2021 Activities

By focusing on our employees, we create opportunities for their development.

With our electricity and natural gas trading companies, we are Turkey’s leading energy trade player in the industry. We optimize our diversified power generation portfolio of 3.6 GW in over-the-counter and organized markets. We create value for our shareholders and business partners with structured products such as price fixation, capacity leasing, and balancing services. With our Enerjisa Europe company, we aim to be among the leading energy trading companies in the European energy market. We continue to carry out our trade activities, which we started in 2021 in the Eastern European energy markets, effectively.

29 TWh

trade volume

Trading with Structured Commercial Products

Through our electricity and natural gas trading companies, we create value for our business partners and stakeholders in every link of the trade value chain with structured commercial products such as:

- Implementation of energy trading strategies (prop trading) independent of the generation of power plants,

- International energy trade and optimization,

- Natural gas trade,

- Virtual Switchboard (VPP) solutions,

- Fixed price purchase guarantees for RES, GES and HEPPs,

- Balancing services,

- Market access services to spot and futures markets,

- Carbon trading,

- Customized energy solutions for large end users and integrated electricity and natural gas supply/storage solutions for sophisticated customers.

We create value for our internal and external stakeholders by reading market dynamics well, analyzing the needs of our stakeholders accurately, and managing risks with the tools we have developed. We never compromise on contract reliability while managing processes.

Expert in Market Analysis

Climatic and seasonal effects, regulatory changes, macroeconomic and political indicators and the relationship between them are the main factors that designate the market. By supporting these factors with mathematical models, our market analysis team offers forecasts about the future and supports the relevant departments in creating their commercial strategies. These models are fed from fundamental data, enabling the Company to formulate a strategy against unexpected situations that may occur in the market under many scenarios, and to be in an advantageous position in the market. Our market analysis stand out in the industry with our expert staff, our digitalization steps, our sophisticated models developed in-house, and our diversified portfolio.

2021 has been a productive year for Enerjisa Üretim in terms of market analysis. We carried out important studies on data analytics. We have made significant progress in preparing for the future with database creation, data processing and data automation.

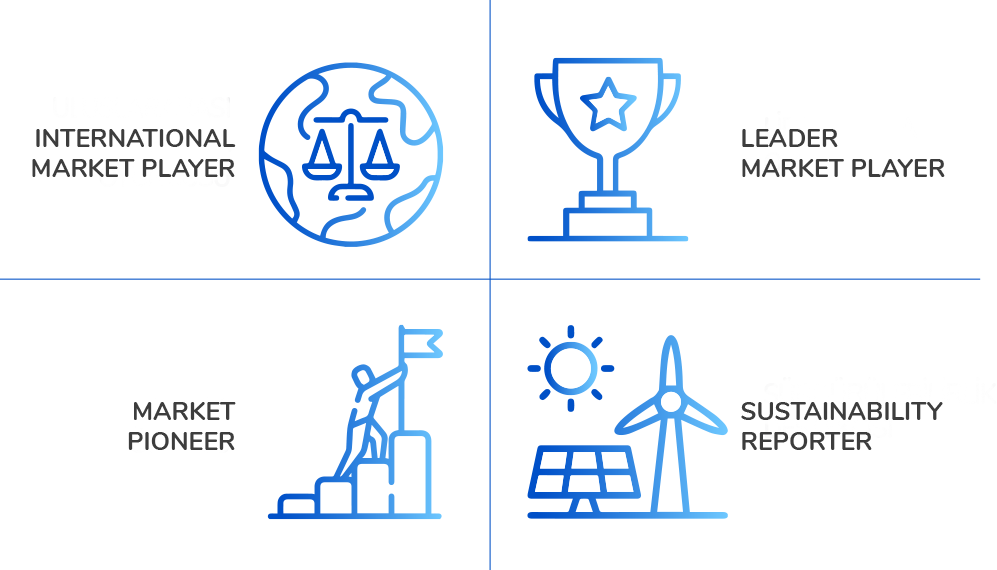

International Market Player

Enerjisa Europe is an international market player with the financial and legal infrastructure required for trade activities in 4 countries, its trained human resources and its vision.

Leader Market Player

Leader in OTC and VIOP markets with trade and sales volume exceeding 24,2 TWh.

Market Pioneer

Pioneer in structured products such as power plant risk management, options trading, virtual exchanges, balancing group.

Sustainability Reporter

Sustainability supporter with innovative and green customer processes, carbon neutralization and green energy.

Our Trade Volume in 2021

Trade teams can set strategies and take positions in the energy markets, within certain risk limits, according to energy price forecasts, and independent from generation operations. These strategies are mostly guided by market dynamics, forecasts and market analysis.

The following were the main topics that stood out in terms of structured products in trade and energy:

- Development and implementation of commercial strategies independent of power plants

- Cross-border electricity trade

- Natural gas trade

- Balancing services

- Customized solutions for renewable power plants in the market Piyasadaki yenilenebilir santrallere özel çözümler ve

- Customer solutions for the end consumer

Our 2021 trade volume increased by 65% compared to 2020, with 59 TWh, despite all the negativities experienced in the global energy markets in 2021. According to the Energy Trade Association reports, we have consolidated our position as a buyer or seller in most of the transactions in OTC markets. In addition to OTC, we made great efforts to increase the liquidity of the futures electricity markets by making continuous purchase and sale offers for products traded in organized electricity markets such as VIOP and VEP. In 2021, we started commercial gas activities in addition to electricity trading (and other than gas purchases for 2 power plants) and traded 740 mcm of gas. While our 2021 consolidated turnover is 16 billion TL, it is 12 billion TL for Tradeco legal entity.

Natural Gas Trade

Analyzing the gas market dynamics in Turkey and globally, we aim to provide incremental profitability with standard and non-standard trading operations, contribute to the growth strategy and prevent / reduce / transform existing risks. In addition, we strive to make the power plants competitive in the market by managing structural gas purchase agreements for the needs of our natural gas power plants and to capture the forecasted value from these assets. In line with our vision, we carried out the following tasks in terms of trade in 2021:

- We achieved 40% share in all electricity trade volume traded in various markets.

- We have become one of the companies with the largest volume in this field in Turkey with a free consumer portfolio of approximately 6 TWh.

- We realized our first financial and physical transactions in the Eastern European energy markets with Enerjisa Europe.

- We have actively started carbon trading (international, national).

- We closely followed the developments in the market for liquefied natural gas and cross-border gas trade.

- In line with the target of increasing gas trade operations, we increased the number of market stakeholders we touch.

- We managed the risks created by the effect of oil prices on gas prices in line with the hedge strategy.

- We provided support to associations such as EÜD and TÜSİAD to manage important changes for the Turkish gas market, such as the Futures Gas Market, end-consumer flexibility and import/export requirements.

- We successfully managed the uncertainty in the natural gas end-consumer portfolio due to the COVID -19 pandemic.

Balancing Services

We can define the purpose of balancing services as reducing the loss due to imbalance by matching the energy imbalances of power plants and consumer portfolios. In 2021, we created value for both our power plants and our stakeholders in our balancing services by reducing their costs.

Customized Solutions For Renewable Power Plants

The fixed-price purchase guarantee mechanism (YEKDEM), designed by the government for the expansion of renewable energy generation plants in Turkey, has been successful. The share of renewable resources in installed capacity has exceeded 50%. We think that the power plants, which will be excluded from the incentive mechanism for 2022 and beyond, will be faced with constantly changing spot prices in the free market. With the expertise and knowledge of Enerjisa Üretim’s trade team, we offer the solutions that these power plants will need against variable price and imbalance risks. We strive to ensure the continuity of the profitability of the power plants following the incentives as well. Our plan is to become a leader in this field with the investments we have made in our IT infrastructure. As of 2021, we signed fixed price purchase and power plant management agreements and started the commercial management of power plants that are not owned by themselves.

Flexible and Wide Product Range Oriented Customer Solutions

The supply needs of end users can differ significantly from each other. The population served includes many consumers. An industrial institution whose daily average consumption does not change, consumption points that change periodically or depending on the dynamics in its own sector, and consumers who have high consumption or do not want to be exposed to energy risk by hedging are some of the different groups. With our product diversity, strong financial structure and pricing flexibility, we are able to provide products according to the needs of all market players. We treat these consumers with different needs as a customized trade channel. We meet the expectations of our customers not only with alternative pricing options, but also by sharing our experience in infrastructure, legislation and practice in the sector. The Customer Solutions Unit works to supply the energy generated at our power plants or obtained from the spot market to consumers whose consumption is above a certain amount, or to reduce their costs with different solutions. It also carries out projects creating alternatives with the support of in-house optimization/structured products team. Within the frame of this activity in 2021, we realized approximately 6 TWh of trade and created an incremental turnover of 3.8 billion TL. In 2022, we aim to be one of the industry leaders in these fields of activity.

Enerjisa Access Will Carry Customers to the Digital World

The concept of digitalization increases its significance concerning the relationship between energy supplier and consumer, as it is in all spheres. Together with the “Final Source Supply Tariff”, where dynamic pricing is at stake, “Energy Literacy” plays an even more vital role for customers. Concepts such as “Ptf”, “Yekdem”, “Imbalance”, “Financial Cost”, “Consumption Forecast” start to take part in the lives of customers. Regarding digitalization, which has become even more critical during the pandemic period, we offer digital solutions that can reach customers directly.

The “Enerjisa Access” service that we have implemented is positioned as an essential tool that can answer all the questions of the customers. By the virtue of Enerjisa Access, customers can monitor their entire performance and make instant cost calculations. This way, the monthly periodic invoicing is no longer a surprise for customers and turns out to be an area they can control. With Enerjisa Access, consumers can create their energy purchasing and usage strategies by means of the analysis screens that include not only the control and monitoring mechanism, but also the forecasts for the future period.

Renewable Energy Consumption and Certification

The increasing emphasis on “green” solutions in the international arena and particularly in the European region is leading renewable energy to be an emerging business line. Industrialists are increasingly emphasizing the need for voluntary carbon balancing in order to carry out exports to developed economies. At this point, our major goal is to develop the decarbonization certification projects of our assets and to set up the offset or trade mechanism in the best possible way. Secondly, we aim to position ourselves as a recognized market player in the voluntary carbon market. We target not only large segment customers, but also organizations that export and need this document abroad.

We consider the decarbonization certification project as a win-win situation for all parties. In 2020, we started our efforts to increase the green market literacy of large/medium segment consumers and low-scale renewable energy generators who do not have sufficient knowledge and resources to develop and market their carbon. In 2021, the number of consumers for whom green-certified energy bills were issued increased significantly. We work with different source types and different energy certificates in order to cater to the different preferences of companies and the countries they export to. All of these certificates are internationally recognized from Africa to America, from China to India, and they provide benefits to customers at different export points. Since we have different types of clean energy sources and different certificates (Gold Standard, Verra VCS, IREC), we provide flexibility to consumers in their preferences.

Enerjisa Europe

Cross-border Trade And Eastern European Energy Markets